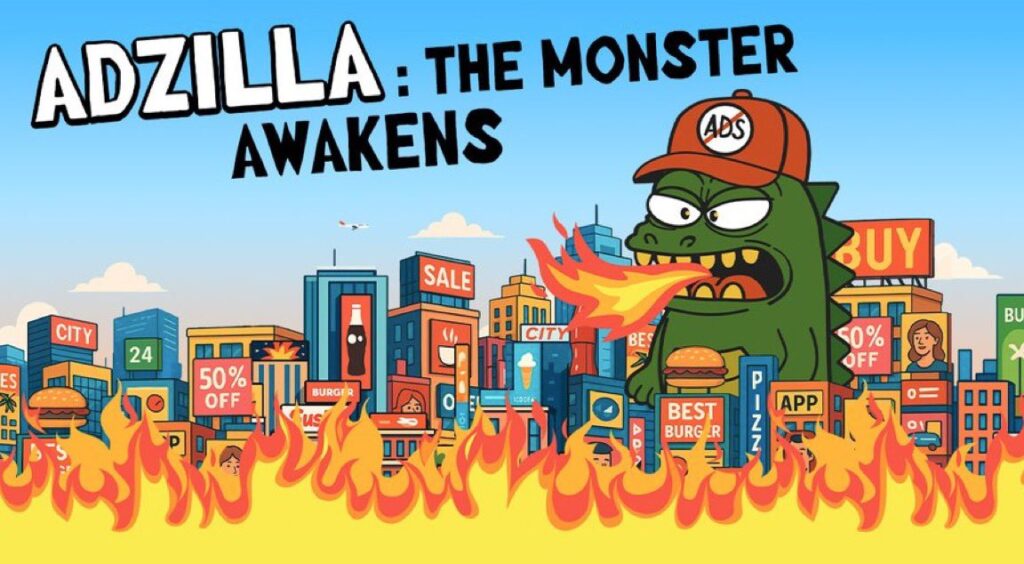

Adzilla: The Huge Memecoin Monster Devouring the Crypto Landscape

Imagine a beast rising from the wild world of crypto, jaws wide open, swallowing up attention and cash like it’s nothing. That’s Adzilla, the huge memecoin monster that’s turned heads and shaken wallets. This isn’t your average dog or frog token—it’s a force built on raw energy, a tight-knit crowd, and a story that sticks.

You might wonder what makes Adzilla stand out in a sea of hype. It grabs the spotlight with its monster theme, poking fun at how big projects can eat up the market. In this piece, we’ll break down what powers Adzilla, from its roots to its wild ride so far, and what lies ahead for folks eyeing a slice of the action.

Decoding the Adzilla Phenomenon: Core Mechanics and Tokenomics

Adzilla kicked off as a joke that hit big, born from a small group of crypto fans tired of the same old memes. They wanted something bolder—a giant lizard rampaging through the blockchain, symbolizing how memecoins can topple giants. The vision? Turn fun into real community power, where holders call the shots.

At its heart, Adzilla aims to flip the script on boring coins. It fills a gap in the fun side of crypto, dominating chats with its playful roar. No heavy promises here, just a space where people bond over laughs and gains.

The Genesis and Vision Behind Adzilla

The team behind Adzilla started it last year in a casual Discord chat. They drew from old monster movies, crafting a tale of a beast that grows with its fans. This sets it apart—no cute animals, but a fierce icon that screams strength.

What problem does it tackle? In a market full of copycats, Adzilla carves out a niche for bold, unapologetic vibes. Its mission stays simple: build a crew that lasts, using memes to drive real talk about crypto’s wild side.

Fans love how it mixes humor with hints of utility, like staking for fun rewards. This keeps the energy high without overpromising.

Analyzing Adzilla’s Token Distribution and Supply Shock

Adzilla caps its total supply at one billion tokens, with about 70% now in circulation. They burned a chunk early on to create scarcity, mimicking a monster’s endless hunger. Team tokens vest over two years, so no quick dumps.

This setup pushes holders to stick around. A small tax on trades—say, 2%—feeds back into a reward pool, cutting short-term flips. It rewards patience, like feeding the beast to make it stronger.

Burns happen with each big milestone, tightening supply over time. This design sparks that “hold on tight” feel, turning speculation into something steadier.

Community Governance and Decentralization Efforts

Adzilla runs on a basic DAO where token holders vote on updates. Recent wins include a community pick for new artwork that boosted social buzz. Folks proposed it, voted, and now it’s live—proof the crowd leads.

Decentralization shows in how they spread control, no single boss in charge. This builds trust, as decisions feel fair.

On socials, Adzilla packs a punch: over 200,000 on X, with posts racking up thousands of likes. Telegram hits 150,000 members, buzzing daily. Discord? 50,000 strong, full of idea swaps. These numbers scream a lively base.

Market Momentum: Metrics and Real-World Traction

Adzilla’s price shot up fast, hitting peaks that drew eyes from all over. It crossed key market cap lines in weeks, with gains stacking 500% in a month. This pattern shows steady climbs mixed with hype bursts.

Traders watch volume closely—it’s held strong after early spikes. Listings on big spots like Uniswap and then Binance fueled jumps, pulling in fresh buyers. Each new exchange adds gas to the fire.

Tracking Adzilla’s Explosive Market Performance

From launch, Adzilla climbed quick, touching all-time highs early on. Market cap soared past mid-tier levels, outpacing many rivals. In the last 30 days, it grabbed double-digit growth, week after week.

Volume stays healthy, not just flash-in-the-pan stuff. Spikes tie to viral posts or listings, but the base holds firm. This mix hints at real interest, not pure pump-and-dump.

Exchanges keep adding it, from decentralized ones to majors. Each step lifts liquidity, making trades smoother for you.

Real-World Adoption Vectors: Use Cases Beyond Hype

Adzilla linked up with a DeFi app for easy swaps, adding real perks. They tied into an NFT drop where holders snag exclusive monster art. This turns tokens into collectibles, not just numbers.

Partnerships pop up too—a gaming project uses Adzilla for in-game buys. It’s small now, but it plants seeds for more. No big business tie-ins yet, but the buzz draws talks.

Metaverse plans simmer, with virtual lands themed around the monster. This could pull users into fun experiences, boosting daily use.

Investor Sentiment and Whale Activity Analysis

Whales—those big holders—pile in during dips, snapping up chunks. Public trackers show them adding to bags, which calms retail nerves. When they buy, smaller players follow, chasing the wave.

Sentiment runs hot on social tools, with positive chatter outpacing doubts. Mainstream sites mention it now, blending crypto die-hards with new faces. This shift widens the net.

Whale moves sway prices, but the crowd’s steady buys balance it. Watch for patterns; they often signal turns.

Navigating the Hype Cycle: Risks and Due Diligence for Investors

Memecoins like Adzilla ride waves of excitement, but crashes hit hard. Hype can fade if the story stalls, leaving bags light. Spot signs like slowing social growth to know when to pause.

Overvaluation lurks when prices outrun facts. Check trading depth—if it’s thin, exits get messy.

Identifying Potential Overvaluation and Market Saturation

Adzilla shines, but it leans on buzz more than deep value. Volatility means quick ups and downs; one bad tweet can tank it. To spot saturation, track if memes feel forced or engagement drops.

Rivals chase the same crowd—think other animal-themed coins. Adzilla’s edge? Its monster lore and active DAO. That moat helps, but watch copycats.

Stay sharp: Set limits on what you’ll risk. Hype cycles end; smart plays last.

Security Concerns and Smart Contract Audits

Audits matter big time for peace of mind. Adzilla got checked by a firm like PeckShield, finding no major holes. They fixed small issues fast, sharing reports online.

No big breaches so far, but always verify. Scams lurk in fakes, so double-check addresses.

Here’s a quick checklist for you:

- Scan the official site for audit links.

- Use tools like Etherscan to view the contract.

- Ask the community about team doxxing or locks.

- Test small buys first.

This keeps you safe in the wild.

Regulatory Headwinds Facing Large-Cap Memecoins

Big memecoins draw eyes from regulators worldwide. Rules tighten on speculative stuff, targeting pumps that hurt newbies. Adzilla could face scrutiny if it grows too fast.

Liquidity pools help—spread out control dodges “centralized” tags. Stay decentralized to ease risks.

Global shifts mean watchfulness; one country’s ban ripples. But strong community buffers blows.

The Future Trajectory: Expansion Strategies of the Memecoin Monster

Adzilla’s roadmap lays out clear steps. Phase one nailed the launch; phase two rolls out staking perks soon. Mid-term? NFT marketplace and game tie-ins by year’s end.

Treasury funds back this, aiming at GameFi for play-to-earn fun. Layer 2 moves could cut fees, drawing more users.

Growth feels planned, not rushed.

Planned Developments and Ecosystem Growth

Next up: A mobile wallet for easy access. Then, cross-chain bridges to hit other networks. These open doors, pulling in fresh crowds.

Diversification hits gaming hard—imagine battling as Adzilla. Funds from taxes fuel it, keeping things self-sustained.

Expect updates quarterly; the team shares progress openly.

Global Outreach and Cultural Integration

Marketing pushes into Asia and Europe, with localized memes. Asia campaigns use dragon twists on the monster tale. This adapts the story, making it click locally.

Community efforts scale in places like Brazil, with meetups and airdrops. Numbers grow there, adding diverse voices.

The narrative flexes—fierce in the West, clever in the East. This keeps the roar global.

Conclusion: Positioning Adzilla in the Crypto Pantheon

Adzilla claims a top spot among memecoins, fueled by its beastly charm, smart token setup, and perfect timing. It devours doubt with community fire and steady gains. For investors, it’s a wild ride worth watching.

Key Takeaways:

- Adzilla thrives on monster memes and fan votes that align everyone.

- Watch volatility close—hype drives it, but dips test resolve.

- Roadmap hits like NFTs and games will decide if it grows beyond the buzz.

Ready to join the hunt? Grab some Adzilla and see the monster in action. Just play smart.